-

Savings AccountsMember deposit every dayto get return on maturityBanking solution for savings & credit Co-operative society, employee credit societies, multistate cooperatives!

Savings AccountsMember deposit every dayto get return on maturityBanking solution for savings & credit Co-operative society, employee credit societies, multistate cooperatives! -

Loan type, tailored for you.Borrow up to ₦10,000,000Low InterestFixed Term Personal Loan

Loan type, tailored for you.Borrow up to ₦10,000,000Low InterestFixed Term Personal Loan

Types of Personal loan

Wedding Loan

Financially unite, love's foundation strengthened, wedding dreams flourish with a loan's aid.

Apply Now Learn More

Holiday Loan

Holiday loan: Financial freedom to make your dream vacation a reality.

Apply Now Learn More

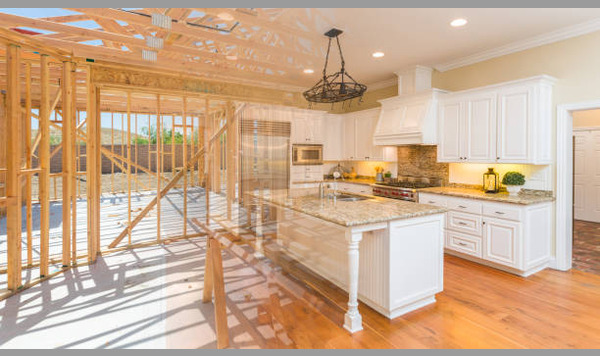

Home Renovation

A financial lifeline for transforming houses into dream homes, making renovation dreams a reality.

Apply Now Learn More

Top Up Loan

Top-up loans provide borrowers with additional funds on top of their existing loan amount, offering flexibility and convenience for various financial needs.

Apply Now Learn More

Fresher Funding

Empowering aspiring talents with financial support for a promising start.

Apply Now Learn More